How Does Customer Churn Analysis Help You Grow Revenue

It doesn’t matter if you’re in B2C, B2B, SaaS, or any other form of business. There’s one thing every business finds painful – losing customers.

There can be multiple reasons why a customer would want to or wouldn’t want to keep doing business with you. Understanding what is causing these two things is crucial for running a successful business.

The SaaS, Media, FinTech, and EdTech industries are especially vulnerable to high customer churn rates. The customer churn rate for these sectors ranged from 63% in SaaS to as high as 96% in EdTech.

Customer churn rate can be reduced using customer churn analysis. By understanding how frequently the customers are leaving, why they are leaving, and what are the common factors driving their decision to leave.

Let’s learn more about it!

What is Customer Churn Analysis?

Customer churn analysis is the process of analyzing churn to understand and generate insights into the following:

- What percent of customers are leaving?

- Why are they leaving?

- What are the commonalities between them?

- Which customers are most likely to leave next?

- What can be done to reduce churn?

Unlike what most think, customer churn analysis isn’t just limited to calculating the churn rate. It is about understanding the factors causing churn and taking up measures to curb customer churn.

Source: hevodata.com

Losing customers is inevitable when it comes to running a business. However, by understanding why they are leaving, you can identify all the ways you can improve your offerings. Thus, customer churn cannot be eliminated but surely minimized.

A lot can be learned by comparing customer churn rates over different time frames and observing other KPIs to identify churn causes. Adopting corrective actions to curb these causes will result in a higher retention rate and higher profits for your business.

Let’s understand why customer churn analysis is so important.

Why is Customer Churn Analysis Important?

It is difficult to identify pain points in your product or customer journey without understanding the customer’s perspective. Customer churn analysis can benefit you in the following ways:

Highlights Product Strengths and Weaknesses

What your product offers in terms of value, utility, and user experience is important. Sometimes there is a mismatch between the perceived value and the experienced value of a product.

Customer churn analysis highlights this mismatch along with other pain points affecting the product value negatively. At the same time, the strengths of the product are also identified, thus, one can improve a product and match the customer expectations.

A common strategy would be to understand prior product usage prior to churn or talk to the churned customer directly. You can use a tracking software to track how customers engage with products.

Identifies Opportunities to Improve Communication

Sometimes, the issue isn’t the product but the customer experience along the journey. Customer experience has become a major determinant in a buyer’s purchase decision.

Customer churn analysis reveals customer behavioral trends at every touchpoint. Using this insight, you can optimize your communication to offer a more personalized experience that meets customer expectations. Shameless plug here 😀 but you can use a tool like Salespanel to track how customers engage with your product or marketing content at every stage of the customer journey.

Enables You To Project and Reduce Future Churn

Customer churn analysis involves utilizing a lot of historical customer data. Aided by other business data, you can create accurate projections about expected churn rate trends for the future.

Source: hevodata.com

By accounting for other KPIs such as Customer Lifetime Value, you can attain a better understanding of the cause-effect relationships of customer churn. Thus, you can adopt a proactive strategy to reduce the expected level of customer churn.

Lowers CAC and promotes Revenue Growth

It is a well-known fact that retaining an existing customer is 5 to 7 times more cost-effective than acquiring a new one. That was-pre pandemic. As of now, the figure might even be higher considering how CACs have increased across the board.

Customer Churn Analysis allows you to improve your business on multiple counts. As a result, your business is not losing customers and hence sees a net positive growth in customer base. This leads to solid revenue growth and lower CAC for your business.

Increases Opportunities for Upselling and Cross-selling

Customer churn analysis helps you improve your products and services, customer service, and other aspects of a business. As a result, you retain more customers as they are satisfied and happy with being your customers.

Such existing customers already trust your brand and thus it makes it easy for you to upsell and cross-sell to them. This ability means you save on a lot of marketing and sales-related costs, thereby significantly lowering the CAC further.

Now you know why customer churn analysis is important. But why and how does it happen? Let’s find out!

Reasons and Manners in Which Customers Churn

Customers will end up churning because of different reasons and in multiple ways. Knowing the reasons and manner in which they leave will help you tackle each issue with a good strategy.

Voluntary Active Churn

This churn happens when a customer cancels the order or subscription directly. There could be many reasons behind this.

Poor customer experience, service, poor onboarding, mismatch in terms of customer expectations and product utility, better value offered by the competition, etc. are some of the common reasons.

Voluntary active churn forms the major proportion of customer churn. Thus, having an effective customer retention policy in place is a must.

Involuntary Passive Churn

Ever forgotten that your card’s validity has run out? Or did the transaction not go through? Well, you are not alone. A lot of customers face such issues. When a customer’s payment is not completed, it is counted as an involuntary passive churn.

Multiple reasons may cause this:

- Bank declined the card.

- The validity of the card is over.

- Hard declines when a card is reported stolen or lost.

- Soft declines when a card has maxed out its limit.

This type of customer churn is easy to curb. Implementing a smart dunning workflow can drastically reduce involuntary passive churn.

The Downgrade Churn

This type of churn occurs when a customer opts for a lower-tier plan compared to the present one. This downgrade results in a downgrade in your recurring revenue.

The reasons for this could be:

- Price Sensitivity

- Mismatched Value Proposition

You can reduce this type of churn by offering the customer the value and utility they desire. You can also provide a customer with offers and more features to prevent downgrades. I am sure you have tried to downgrade from some product only for it to throw you an offer. That’s the most common strategy to avoid this type of churn.

The “Good” Churn

Not all customers are a good fit for your product. You attract non-ideal customers when your targeting accuracy for marketing campaigns is off. So, when such a customer leaves, it is considered a good churn.

Customers who undertake different projects may also terminate their subscription once a project is over and their short-term needs are fulfilled. However, these customers tend to return for new projects, you can track these through their reactivations.

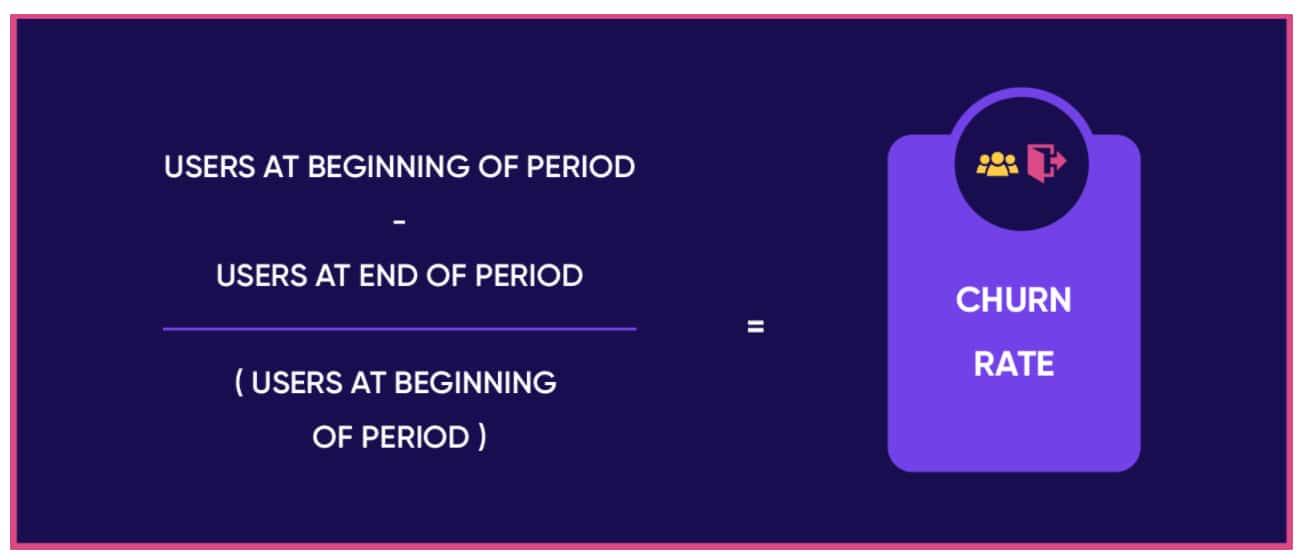

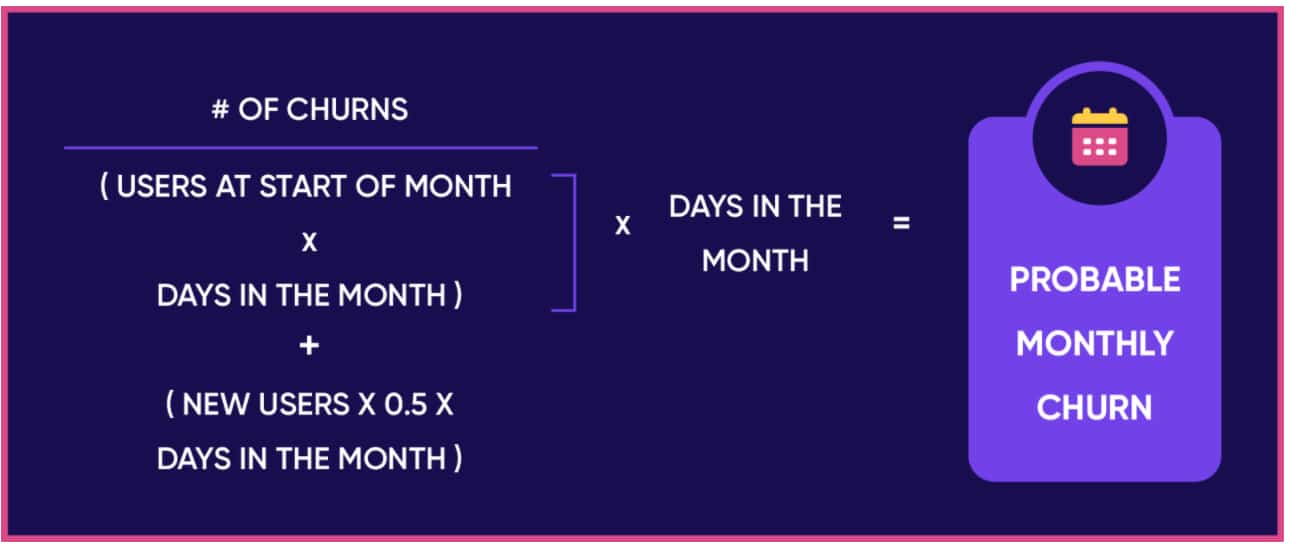

Calculating Customer Churn

The customer churn rate is an important metric that needs to be monitored carefully. It is especially relevant for B2B and SaaS firms. Business sectors that are characterized by stable MRR also benefit a lot from monitoring churn rate.

So how do we calculate customer churn rate? Here’s the formula for it:

Churn rate = (Customer Lost / Total customer at the start of the month) X 100

Let’s consider an example. A company had 30000 customers at the start of the month. Ended up losing 5000 by the month-end.

Thus, churn rate = (2000 / 30000) X 100 = 6%

Now you know why customer churn analysis is important. Let’s check how you can rectify the causes of customer churn.

Identifying and Rectifying Causes of Churn

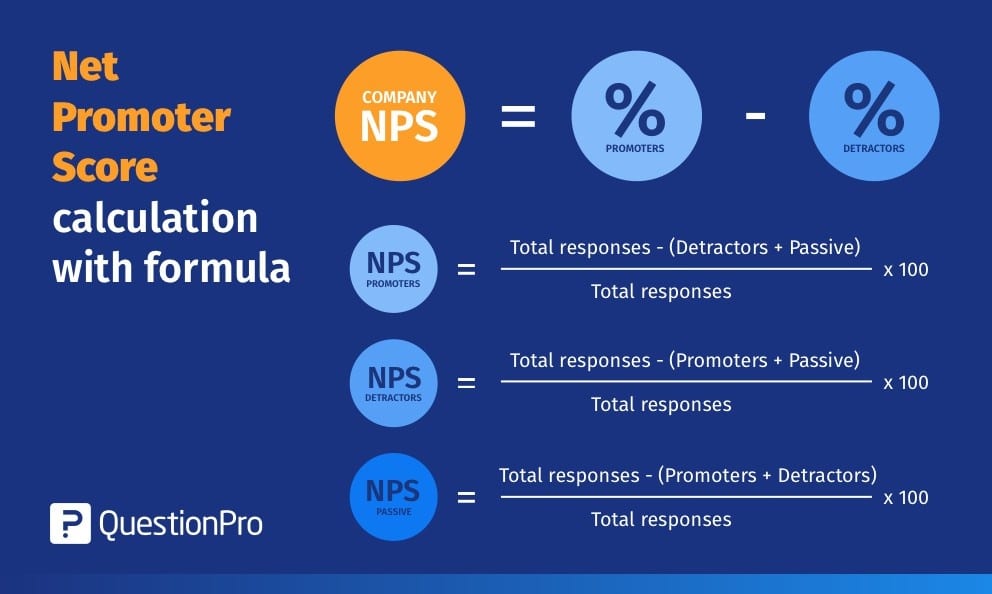

Track and Monitor your Net Promoter Score

The NPS track how many of your existing customers are satisfied with your offerings and would recommend your brand to other people. This is a good way to identify all your loyal customers (promoters) and detractors (dissatisfied customers).

Source: questionpro.com

You can use the NPS as an indicator for expected customer churn. Corrective actions can be thus initiated before the customers are lost.

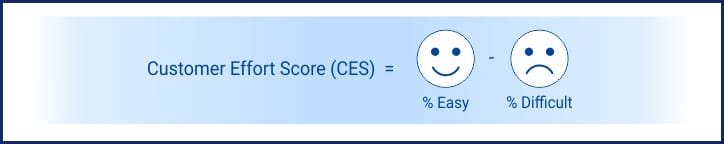

Monitor your Customer Effort Score

The CES measures how easy your customers find it to use your product and service. The lower the CES is, the easier people find your offerings to use. If you notice the CES rising, you can check and identify what element is causing the trouble.

Source: questionpro.com

The customer service teams can then be instructed to assist customers in overcoming the issue. Thus, you can minimize customer churn resulting from lowering the ease of product or service use.

Ask Your Customers The Right Questions

There’s no better way of knowing if you’re doing things right than directly asking your customers about it. You can either conduct a survey or have a direct dialogue with them.

There are many things you can ask them about in terms of product features, UI, ease of use, pricing, etc. You can even ask them for suggestions in terms of how you can make your offerings better.

Keep Your Loyal Customer Happy

Keeping your loyal customers happy adds a lot to your revenue and bottom line. Loyal customers are invested in your brand and will readily help you with feedback to improve your offerings.

They will also promote your brand and turn brand advocates. This is a lot of free and credible marketing you can benefit from. So have loyalty points and rewards, offer discounts for their birthdays and anniversary, etc. to keep them happy.

Pay Attention to Complaints

Here’s something scary, 96% of the unsatisfied customers never complain. That makes the 4% that do complain very important for you. Make sure you pay attention to any and every complaint being raised.

Chances are it might be affecting other people without them reporting about it. Thus, when you resolve the issues causing the complaints, you resolve issues of way more people than those who reported the issue.

Conclusion

Knowing why a customer might be leaving your brand is very important. It offers a business many opportunities to improve its offerings.

A business can improve its offerings in terms of value provided, ease of use, user experience, customer service, etc. Customer churn analysis is what helps a business identify what needs to be improved.

With this approach, you can not only reduce customer churn but raise the satisfaction level of loyal customers even further.

Sell more, understand your customers’ journey for free!

Sales and Marketing teams spend millions of dollars to bring visitors to your website. But do you track your customer’s journey? Do you know who buys and why?

Around 8% of your website traffic will sign up on your lead forms. What happens to the other 92% of your traffic? Can you identify your visiting accounts? Can you engage and retarget your qualified visitors even if they are not identified?