Conversion Cost Formula for Digital Businesses

Calculating and keeping track of various costs a business incurs while manufacturing goods and services for sale is an essential process in business operations. It has been a standard practice of knowing what it costs to make a product first and then deciding on a reasonable profit margin to come up with a sale price.

Thus costing is an important function and needs to be carried out accurately to ensure no costs are missed, which may eat into a business’s profit margin. The business world has always relied on the Conversion Cost Formula for this very purpose.

So what exactly is Conversion Cost?

WallstreetMojo defines Conversion Cost as

“Conversion cost is the cost incurred by any manufacturing entity in the process of converting its raw material into finished goods capable of being sold in the market and usually includes the total value of labor cost and other applied overheads like factory overheads, administrative overhead, etc.”

Direct Labour accounts for all the costs incurred in employing people who are directly involved in the manufacturing of products or providing a service. Manufacturing overheads account for the following expenses:

- Factory Rent

- Machine and Factory Maintenance

- Factory Insurance

- Material Cost

- Administrative Expenses

- Salary of Production and Administrative Staff

- Transport of raw material and products

- Other ancillary costs

Using Conversion Cost Function for Cost Accounting helps allocate the unallocated expenses, which provides an imperative insight into the production function, which helps in better planning and cost management.

This even enables a firm to account for the value of inventory it holds at all times, which needs to be reported as an asset when filing for tax. Moreover, knowing all these metrics even helps a firm implement the JIT philosophy in their production function. In case inefficiencies are observed, the production function can be reengineered or redesigned as needed.

But what about businesses that produce digital products and services? We have a specific Conversion Cost Formula for that as well.

Cost Conversion Formula for SaaS and Digital Businesses

Digital Businesses and SaaS aren’t like normal businesses owing to the digital nature of their offerings. Hence, accounting for their costs isn’t like normal businesses. Thankfully, the basic formula remains the same. The only thing that changes is the overheads being considered.

Firstly, it is essential to know what all costs have to be accounted for while calculating the Cost Per Conversion. The general rule is to consider all the costs incurred in running the online advertising campaign. Everything needs to be considered, from designing advertising material to the cost of advertising these adverts on various channels.

Cost per Conversion is an important metric used in the online business world to find out how much it actually costs a business in terms of advertising costs to acquire each real customer – the one who actually makes a purchase.

The online Advertising Agencies have made it easier to calculate CPC by providing the customers with “traffic packages” where the customer’s advertisement receives a specific amount of views in a specific time frame for a fixed amount of money.

Image Courtesy – Totempool

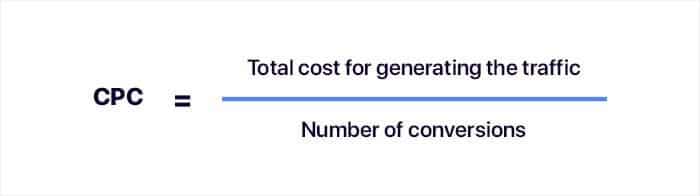

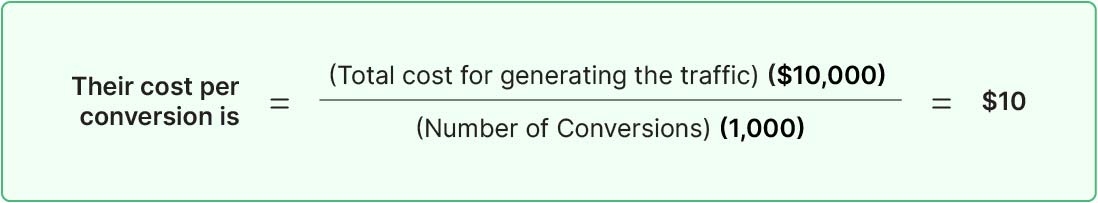

The Formula for Cost per Conversion is simple. It is the total cost incurred for running the online advertising campaign, divided by the number of conversions acquired.

Cohort Analysis

To put it as simply as possible, a cohort is a subset of users grouped by shared characteristics. In the business world, Cohort usually refers to groups of users specifically segmented as per their time of acquisition, i.e., the first time they visited your website, signed up, made a purchase, started their subscription, etc.

When it comes to monitoring business activities, the business world has relied a lot upon performance metrics that are usually in the form of averages. However, averages can be very misleading as they do not represent the true picture of things. Averages suffer from aggregation fallacy and may lead to the management taking a wrong decision.

Breaking down your audiences into subsets with similar attributes helps do away with the aggregation fallacy. This way,, the management can interpret the situation as it actually is and make better decisions for the business.

Cohort Analysis can be used in many different ways to help one in making business decisions. The following are examples of business functions/processes which can benefit from Cohort Analysis:

- Conversion Rate Optimisation

- Better Alternative to AB Testing

- Calculating Lifetime Value of Customers

- Customer Retention

- Revenue Retention

What probably is the best part about cohort analysis is that it tracks behavior metrics of the user base for changes over fixed time intervals. This enables the business to understand a lot of things that are just impossible to interpret using averages.

Let’s consider an example –

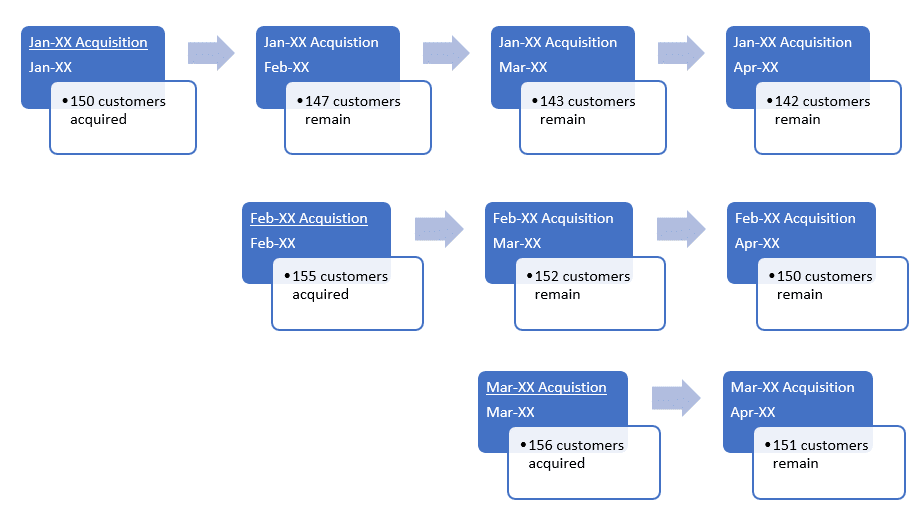

Image Courtesy – TheSaaSCFO

Instead of aggregation, cohort allows us to segment users based on their month of acquisition. This provides a lot of insight into how things are actually functioning. We can clearly see a trend where more customers were acquired with every following month. This is a good indicator of marketing performance.

However, if we consider the number of customers lost every month, we see a steady downward trend. This can be attributed to either lack in the quality of user experience, after-sales support, user satisfaction levels, etc.

Aggregated would’ve instead shown steady growth in the number of acquisitions month on month with the underlying issue of customer retention being missed completely. This is just one way in which Cohort Analysis can help in business decision-making.

How to Calculate Cost per Conversion?

Now, the formula for calculating the Cost per Conversion has been stated earlier as (Total expense incurred for the marketing campaign) / (Total conversions gained).

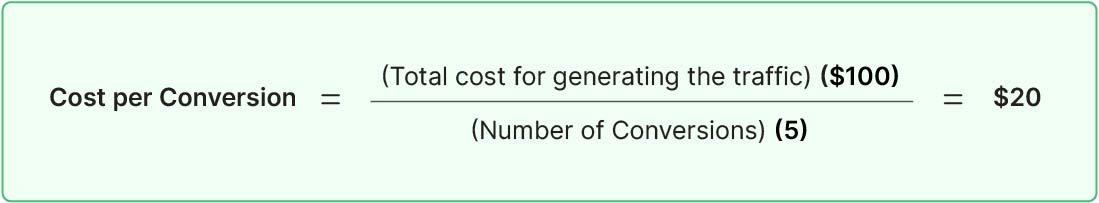

Consider this, if running an ad campaign cost a firm $100 for 100 views and it resulted in the firm acquiring 5 new customers, then,

Thus, it cost the firm $20 for every new customer they acquired. However, this is too simplified; let’s consider some realistic examples.

Example #1 – An E-Commerce Company that sells stationery products.

Consider that this company spends $10000 on online advertisements through various channels and was able to convert a total of 1000 customers.

If we consider the average order value of these 1000 customers to be $40, the business generated total revenue of $40000. If we consider their markup to be about 50%, that means the company made a $20000 gross profit. The marketing expenditure and other overheads will be deducted from this amount to get their net profit figure.

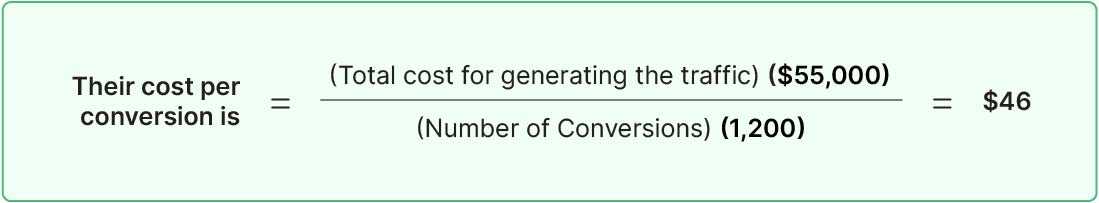

Example #2 – An SaaS Company offering Industrial Design Software

Let us assume that the firm invested $55000 for their online marketing campaign and managed to convert a total of 1200 customers.

If we consider a monthly subscription fee of $30 for the service, every customer will bring in $360 annually. The firm will earn total revenue of $432000. After deducting the marketing expenses, the firm is left with a gross profit of $377000.

The ability to calculate the cost per conversion for your firm presents another question, how much should you actually pay for each conversion? Frankly, there’s no clear answer to this question, and there are many variables that determine how much can be spent for each conversion.

The following are some factors that determine what you should pay for per conversion:

- Type of Industry

- Type of Business model

- Home Market

- Average Order Value

- Lifetime Value of avg customer

- Level of Profit Markup

- Growth Requirement

It might get overwhelming to account for everything yourself and decide on a fair cost per conversion. Thankfully, the internet is a pleasant place with many people willing to help you out with almost everything.

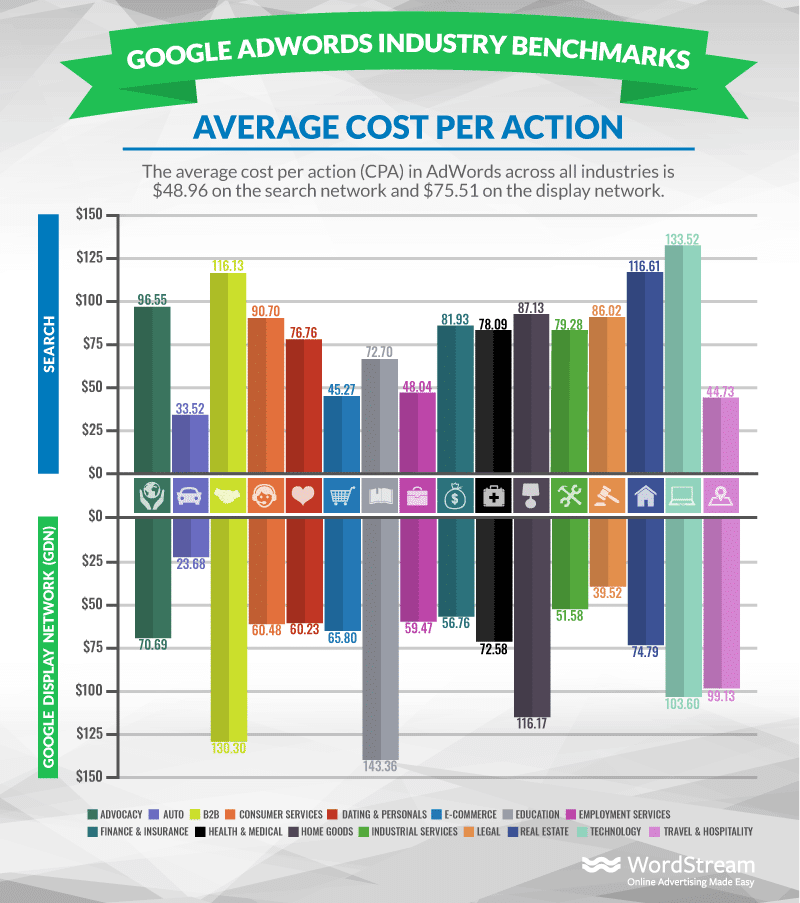

Image Courtesy – WordStream

WordStream compiled the advertisement cost data across various industries to show us the big picture of online marketing costs and other parameters. You can use this as a guideline to see how much you should be spending as per your sector and make changes accordingly.

3 Tips for Reducing your Cost per Conversion

1. Discard low converting keywords – Be a beginner or veteran marketer; when it comes to PPC, one must regularly evaluate keyword performance to identify low converting keywords. These can then be replaced with new ones that have a better chance of generating more conversions.

2. Evaluating Ads Timings – There are going to be certain time frames when your ads generate the most positive impressions and lead to conversions. Using analytics to find these time frames and running your ads within those will save you a lot of resources.

3. Improve your landing page – Audiences that click on your ads end up on your landing page, and how well designed and functional your landing page is, decides whether they will convert or not. Making sure your audiences have a seamless experience, perceive value, and react to your CTAs will lead to more conversions, reducing your CPC.

Conclusion

Digital Businesses and SaaS are nothing different compared to traditional businesses in this sense. These need to have a track of their spending.

Owing to the digital nature of products and services, the costs incurred are very different for them compared to traditional industries.

A major stake in the expenses is acquired by the marketing and advertising function. Thus, it becomes important to keep track of the spending.

One way of doing this is using the Cost per Conversion formula, which allows a firm to understand how much they’re spending to convert each customer.

The firm can then compare its CPC to that of their specific industry to know whether they’re doing good or not. This allows the firm to tweak its marketing function for a better conversion rate which in term will reduce its CPC and bring in more profits.

Sell more, understand your customers’ journey for free!

Sales and Marketing teams spend millions of dollars to bring visitors to your website. But do you track your customer’s journey? Do you know who buys and why?

Around 8% of your website traffic will sign up on your lead forms. What happens to the other 92% of your traffic? Can you identify your visiting accounts? Can you engage and retarget your qualified visitors even if they are not identified?