Predictable Revenue Projection Models for 2022

Running a business is a tricky affair. It is as complicated as playing chess with a world-class opponent. An opponent who is unpredictable, brutally effective, and capable of spoiling your play – the market forces.

Similar to chess, running a business is both an art and a science. One way to get better at this, to come on top of your opponent every time, is to have accurate foresight. Even if you keep competitors out of the equation, it is always a good idea to foresee if you are on track to reaching your goals. Knowing what the future might be like will help you make the right moves in the present.

This foresight is Revenue Projection. Knowing what your profit potential would be, a few months or quarters into the future, will help you plan better and hit your goals consistently.

You will have more control over your operations and cash flow. The best thing is that you won’t be caught off guard if there are sudden shifts in the market. This ability to gauge and anticipate future revenue offers a significant competitive edge.

Let us learn more about it!

What are Revenue Projections?

Revenue projection is a predictive estimation of the revenue a business will generate over a certain period. Revenue projection is a science as it is calculated using analyzing past revenue data, product cycles, and market trends.

However, it isn’t always possible to predict the market with 100% accuracy. This is where revenue projection becomes an art. The senior executives use their experience and market understanding to tweak the projections.

The result? A revenue projection that is driven by data, experience, and instincts. All three factors compensate for each other’s fallacies. As a result, you have a more realistic revenue projection.

People often use revenue and sales forecasts interchangeably. However, this is incorrect. A sales forecast is only limited to sales revenue. A firm’s total revenue may include more revenue streams than just sales.

There are cash inflows such as royalty fees, rent, interest, lawsuit settlements, etc. that are considered a part of the firm’s revenue. So, revenue projection includes sales projection and considers all other forms of anticipated cash inflows too.

But how does one come up with revenue projections? For that, we have revenue forecasting models. Let us learn more about these.

Revenue Forecasting Models

One thing common about all revenue projection models is that none of them are 100% accurate. These projections are done based on historical data.

While not 100% accurate, revenue projection models help understand the general state of revenue generation for the immediate future.

1. Straight Line Forecast Model

This is the most basic and mathematically simple forecasting model. All you need is historical growth data about the firm’s financial growth over the years. The more data you have, the more accurate this projection ends up being.

Source: aviso.com

Let’s assume your firm’s revenue has grown steadily by 5% YoY. This model applies the growth rate to recorded revenue over the recent time frame and plots a straight-line projection.

While simple and useful, this model does suffer from aggregation fallacy.

2. Moving Average Forecast Model

A moving average is a statistical projection that smooths out data fluctuations by plotting a series of constantly updated averages. Consecutive subsets of the full dataset are used to calculate these averages.

Source: aviso.com

This model accounts for revenue fluctuations over the set time frame. The lack of simplicity of this model is compensated for by its higher level of accuracy. However, this model is suitable for short-term projections, i.e. a few months or quarters.

The nature of the mechanism of this model creates lag when used for long-term revenue projections.

3. Time Series Forecast Model

This revenue forecasting model is complex and data and computation-intensive. Using the revenue data available with a firm, a program is used to conduct a time series analysis.

Source: aviso.com

This time series analysis accounts for fluctuations, and market changes and identifies various patterns. Considering the historical trends, present data, and financial indicators, the program can accurately plot a revenue projection.

This model is the best match for industries and firms that perform consistently but are affected by market forces most of the time.

4. Linear Regression Forecast Model

A linear regression forecast model plots a projection based on the observed relationship between two or more correlating factors. In this case, these correlating factors are usually indicators that determine revenue output.

Source: aviso.com

Similar to time series analysis, historical data is used here as well. The only difference is that this method of modeling isn’t as computation or data-intensive. Thus, this model has the accuracy required along with a level of simplicity unseen with time series.

Moreover, having multiple correlating factors for projection accounts for the various changes in the market that cannot be accounted for using other methods.

But how can you get more accurate revenue projections? You will need a robust revenue forecasting strategy for that.

Revenue Forecasting Strategy for More Accurate Projections

Taking data and running it through a revenue projection tool is not going to suffice. A lot of other things need to be taken care of to ensure the projections come out accurate.

So make sure you follow the given steps for accurate revenue projection.

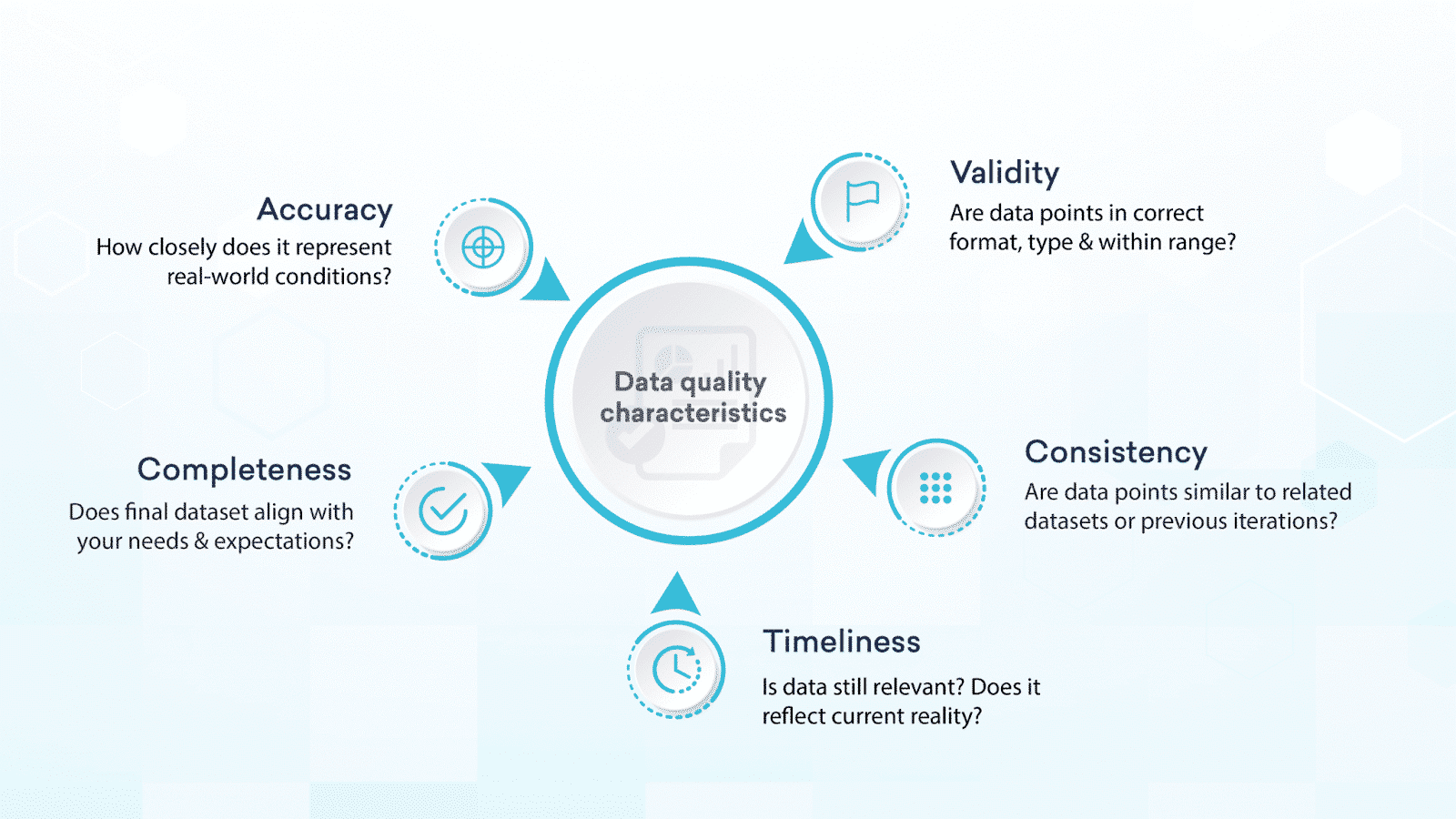

Update and Validate Data

As the saying goes, you cannot make good decisions based on bad data. Data forms the basis for any form of revenue projection. Irrespective of the model you use, ensuring the quality of data is important.

Source: grepsr.com

What you can do is, have the data collection mechanism automated. It will do away with all human errors. After that, have your data filtered and cleaned for inaccuracies, gaps, and redundancies. Have a central data repository to store all the validated data and update the database regularly so you can have an accurate revenue projection.

Use a Proper Forecasting Tool

If you’re a small business with not a lot of resources to spare, you can get away with using Microsoft Excel for revenue forecasting. Microsoft Excel is a powerful tool. It is more than capable enough to cater to the revenue projection needs of a small business.

For big and medium businesses, we recommend using a proper revenue forecasting tool. You will not only gain an accurate revenue projection but have access to advanced features and options.

Using those, you can generate custom reports, run complex projections, plugin real-time data, etc. These features are necessary for the scale of operation that a big and medium business operates at.

Incorporate Qualitative Data

Technology has advanced a fair bit when it comes to pattern recognition and behavioral analysis. As a result, it is possible to quantify qualitative data to a large extent.

Having this data as a part of your equation for revenue projection is important. Purely quantitative data is never sufficient at offering a holistic view. Taking decisions based on such revenue projections can cause issues.

When you have qualitative data included in your revenue projection equation, it raises its accuracy. Accounting for such factors helps you generate a revenue projection that offers a more accurate and holistic view of potential future earnings.

Include Seasonality as a Factor

It was believed at first that the tech industry was immune to seasons. However, the truth was far from this belief. Like every other industry, the tech sector is also subjected to seasonality.

While it is not as significant as some other industries, it exists. So, it becomes necessary to account for this factor as well.

For example, streaming services might see a rise in subscriptions during the holiday season. Electronic vendors might see a rise in sales right before the college semesters begin. MarTech SaaS businesses may see a rise in subscriptions in the first quarter.

Factoring in for such shifts can help you make better decisions with the help of accurate revenue projections.

Utilize Third-party Data When Necessary

While internal data will always remain primary to revenue projections, it, at times, might prove insufficient. In such instances, it is advisable to acquire and utilize third-party data about your industry.

You can gain a lot of insights from using this type of data. It will also allow you to factor in the changes in the market more accurately and on a broader scale.

Revenue projections made using such data in addition to primary data will significantly raise its accuracy. Moreover, it will provide more depth to the projection and reveal additional details about future market movements.

Using Marketing Data to Predict Revenue

At times it is difficult to find what channel, what touchpoint or what content led to a conversion that generated revenue.

Knowing which marketing elements are responsible for generating revenue is a powerful insight. You can use these insights to not only make every marketing element effective at contributing to revenue generation but also accurately predict revenue through attribution.

Revenue attribution helps you connect your efforts and touchpoints to revenue and determine how much each element contributed. If you want to get started with this, check out Salespanel.

Final Words

Having a clear and accurate vision of the future is important. It helps you stay ahead of the competition through changing marketing conditions and proactively run operations that are projected to reach their objectives.

Many business decisions can benefit from knowing what the profit potential looks like in the future. This will help you decide where to invest in order to stay ahead in the market and grow revenue. Revenue Projections help you achieve this foresight. Follow the strategy in this blog and you will make smart and profitable business decisions.

Sell more, understand your customers’ journey for free!

Sales and Marketing teams spend millions of dollars to bring visitors to your website. But do you track your customer’s journey? Do you know who buys and why?

Around 8% of your website traffic will sign up on your lead forms. What happens to the other 92% of your traffic? Can you identify your visiting accounts? Can you engage and retarget your qualified visitors even if they are not identified?