Role of Chief Revenue Officer (CRO) in 2024 and the Impact on Marketing

Updated on 16th February, 2024.

A chief revenue officer is someone who is responsible for the revenue generation of any business. Someone who can identify opportunities that can result in measurable sales and ultimately growth, in the future. Go a decade back, and you will find one or the other responsibility of a present-day Chief Revenue Officer (CRO) as an integral part of any organization- which means that the role was always there but not in the form it needs to be today.

So, what has changed?

- Digital technology has reduced the gap between sales and marketing.

- With sophisticated sales and marketing automation in place, customer acquisition is easier than ever before.

- The buying life cycles have become more customer-centric as the collaboration between sales and marketing is real, and both share the responsibility of revenue generation.

Revenue marketing has surfaced due to this massive shift to digitally transformed and customer-focused marketing. This has brought the need of a dedicated CRO and a revenue team.

A Chief Revenue Officer is not only accountable for the revenue generation processes but also responsible for integrating various functions, primarily sales and marketing, and anything that can maximize the returns on marketing investment.

You may see CROs advising on pricing, improving the performance of customer support teams, analyzing operations- all this and more, only to create a holistic approach that has a cumulative effect in terms of returns from marketing investments.

What is Revenue Marketing?

Revenue marketing is the process of combining strategies, processes, and technologies to attain certain foreseeable revenue goals. It aims at getting sales-ready leads and making sales and marketing more productive, based on data analysis and optimizations. Understand revenue marketing better from a broader perspective:

- It involves creative, technological, and analytical synergy of various teams.

- Focuses on meaningful omnichannel interactions with prospects and customers.

- Starts at capturing digital footprints, leading to nurture campaigns via various channels like social media, newsletters, communities, etc.

- Buying starts much before the selling process, and sales start when the leads are sales-ready.

- Gives a measurable goal linked to revenue and sets a repeatable process to achieve the bigger and long-term goals of a business.

Revenue marketing with Salespanel

The Rise of Revenue Marketing

For a long time, people rising to senior sales and marketing positions came from sales backgrounds, which clearly shows marketing was not seen as a part of sales (or revenue generation)- in fact, it was seen as the “cost center”. Things have clearly changed!

As a process, revenue marketing provides the needed infrastructure to drive sales- but sales no longer mean making cold calls. Instead, it’s a well-thought revenue generation plan for all stages of the marketing funnel.

Using CRMs and sales prospecting tools, you can actually measure sales and marketing activities across the revenue cycle and take relevant action to meet a predictable revenue goal. The data collected through these tools play a pivotal role in optimizations and making sales and revenue predictions.

Traditionally, marketing was considered a different activity, and sales alone were held responsible for the revenue generation. This has transformed into an aligned sales and marketing process where sales begin right from the marketing stages. As per Zoominfo, companies that have a well-integrated sales and marketing process see 20% annual growth, and B2B organizations attain 24% faster revenue growth in three years.

B2B buying earlier was divided among sales and marketing in a way that the marketing team would reach out to customers and bring leads for the sales team. It divided the process into two halves for both marketing and sales executives, making marketing unaccountable for the end goal, ‘sale’. And, eventually leaving the sales team clueless about the customer engagements and value created for them in the initial stages.

With new technology, both the processes of sales and marketing, have integrated in a way to make businesses discoverable to prospects. Buyers’ journey is more content-driven and engaging now, and that’s why the buyer is through 90% of the buying process by the time they reach the lower sales-funnel.

A huge shift to revenue marketing is the aftereffect of a predictable and scalable sales process that has become possible due to data-driven structures. According to Mckinsey, B2B teams that have embraced the latest data-driven sales practices reported 3% – 5% extra returns on sales.

Revenue marketing helps marketing connect their efforts directly to the sales conversion using a closed-loop system. It also helps sales stay in the loop about marketing engagement and also push nurturing and engagement based on sales requirements.

The Revenue Marketing Team and Why it Needs a Chief

From brand awareness to customer retention everything is taken care of by the revenue marketing team. So, the team involves different contributors such as VP Sales, who takes care of strategic decisions and demand generation.

Business analysts, who keep a close watch on numbers. They are the ones who link efficiency metrics to revenue metrics and bring out a clear picture for sales and marketing teams.

Then there are marketing experts who set up campaigns and monitor progress with regard to goals predicted by the CRO.

The revenue team also consists of a technological or product marketer. A product marketer is responsible for the messaging and positioning of the product. A technical marketer will also be using the state of the art technology to increase revenue.

The creative team comprises graphics and copy creators whose competence decides a lot about the effectiveness of any campaign. Marketo has talked about the Revenue Marketing team in detail on their blog.

Basically, a revenue team is in charge of the whole process from attracting leads to nurturing, and sales enablement. So, the role of a Chief revenue officer is decisive in creating optimized processes and successful collaborations. It’s their vision that enables smooth transitions and effective management of sales pipeline and marketing resources.

Being a CRO you not only think about alignment between sales and marketing but also build ground for future possibilities. Appropriate sales forecasting, implementing cost reduction tactics, improving customer acquisition, and productivity are a few of the major responsibilities that call for outstanding business acumen and understanding of both sales and marketing nuances. A chief revenue officer is a highly skilled and experienced professional with distinct qualities to own the sales and marketing game of a business.

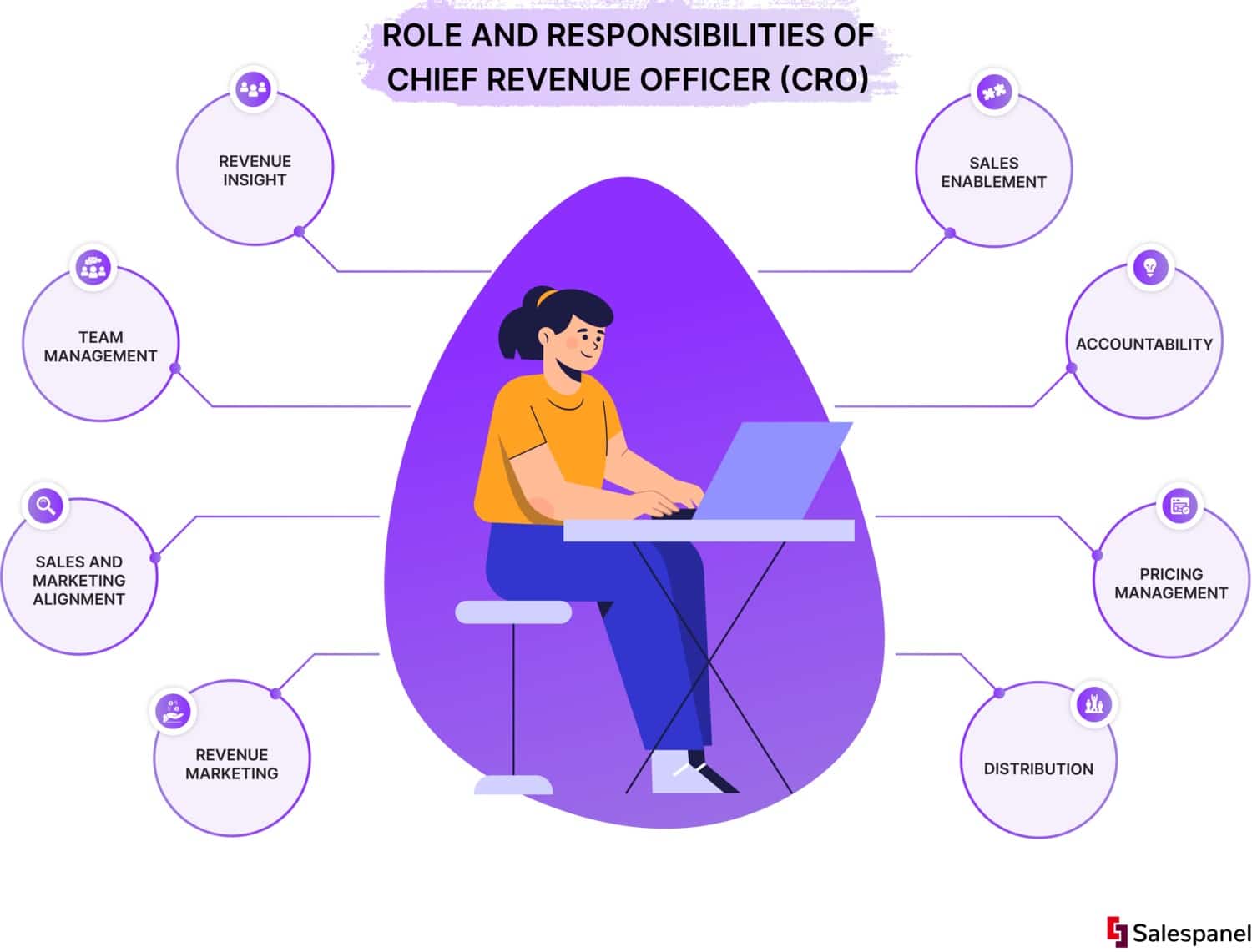

Role and responsibilities of CRO

A Chief Revenue Officer is responsible for the performance of all revenue-generating departments so his/her role entails strategic decisions, partnering with different stakeholders, and working toward long-term goals of a company. To ensure this, you may see her doing a lot of things like:

- Managing teams and driving growth across all functions- sales, marketing, customer experience, etc.

- Helping teams to maximize innovation and sustain revenue growth.

- Identifying opportunities and performing competitive analysis.

- Contributing to product enhancement based on customer insights and changing market forces.

- Collaborating with all teams- finance, product development, marketing, etc. to define pricing and communication strategies, to meet the revenue goals.

- Resolving issues that hinder sales or marketing functions or collaborations.

- Reviewing alliances and improving CRM management.

- Creating accountability based on metrics and directing returns along the process.

Typically, a CRO reports to the Chief Finance Officer (CFO), who is entitled to manage the company’s finance, financial planning, and the risks involved. Rest depends on the size and structure of a company as to who she works with or reports to.

How is a CRO Different From a Chief Sales Officer (CSO), a Chief Marketing Officer (CMO), or a Chief Customer Officer (CCO)?

There is a lot of overlap in what CROs are supposed to do with what CMOs or CSOs have already been doing. So, in this section we try to differentiate roles to avoid confusions!

Differences Between a CRO and a CSO

While both of these positions have a role in overseeing Sales, there are certain differences in their goals and everyday workings.

A CSO’s primary responsibility is to ensure the sales team meets its sales and revenue goals. In contrast, the chief revenue officer is in charge of managing all aspects of a company’s revenue generation process including sales, marketing, and customer success strategies.

The CSO is also expected to be more active in managing the sales force and conducting day-to-day operations which includes hiring, training, and closing deals, as well as developing sales processes and targets. A CRO does not manage salespeople or close deals; instead, they are expected to focus on inter-departmental communication.

The impact that a chief revenue officer creates from a sales aspect involves driving growth through revenue optimization. This entails identifying areas where the sales process may be improved using data and analytics and then putting those improvements into practice by putting plans into place.

Revenue optimization can have a major positive effect on top-line growth by enhancing closing rates and increasing sales process efficiencies. In competitive settings, it can also help to raise average transaction sizes and boost victory rates. Besides this, a CRO can help in increasing customer loyalty and retention by ensuring that consumers receive the greatest experience possible from the sales process. Thus, a CRO plays a crucial role in sales operations.

Differences Between a CRO and a CMO

The role of a CMO is more adjunctive to that of a CRO. While the former role is closely related to the marketing initiatives and processes of a business, the latter is generally in charge of bringing in money for the business and coordinating with other divisions to meet revenue targets.

In short, the chief marketing officer creates and implements a robust marketing strategy, and the chief revenue officer makes sure that the marketing objectives are in line with the company’s long-term revenue goals. This entails planning and directing marketing campaigns, supervising market research, designing branding efforts, and collaborating with the sales team. Increasing sales and revenue is ultimately the responsibility of both the CRO and CMO. However, whereas the CMO concentrates on creating awareness and leads, the CRO is more concerned with the bottom line.

The impact that a chief revenue officer creates from a marketing aspect is to ensure that the go-to-market plan is ideal from a revenue marketing perspective. What does this mean? This implies that all aspects of business operations, including planning and carrying out marketing initiatives and evaluating their effectiveness are focused on increasing revenue. Since the CRO is in charge of creating and implementing the organization’s revenue plan, they must have a thorough awareness of the market, the client base, and growth-oriented tactics.

Besides this, they must be able to synchronize all aspects of revenue generation, including sales, marketing, and customer success. A CRO can achieve this by implementing product expansion in line with evolving market trends, customer insights, and customer feedback, coordinating to define pricing with all departments, resolving issues that cause sales and marketing cycles to lag, and examining and enhancing CRM administration.

Differences Between a CRO and a CCO

The role of a Customer Support Officer actually feeds into the responsibilities of a CRO. While the latter is responsible for generating revenue for the company, a CCO is tasked with ensuring that the customers are satisfied with the product or service, indirectly affecting sales and revenue. Let’s dive into the two roles in a little more detail.

The CRO is in charge of bringing in money through sales. They can do this by creating and executing sales strategies, establishing sales targets, and supervising the sales staff. The Chief Revenue Officer, thus, needs to have a thorough awareness of both the demands of the consumers and the company’s offerings to be effective.

On the other hand, the CCO’s role involves ensuring that consumers are satisfied with the products and services they receive from the business. This entails collaborating with customer care agents to address problems and ensure that they are offering top-notch consumer assistance. In addition, the CCO manages the customer success team, creates and executes customer satisfaction plans, and establishes objectives related to customer happiness.

In conclusion, both a CRO and a CCO need to have an in-depth understanding of the company, the products or services offered, and the customers. However, the chief customer support officer is a supportive professional to the CRO, helping the latter achieve revenue goals by keeping customers happy and satisfied.

The impact a chief revenue officer creates from a customer success aspect is helping make sure that the customers achieve their objectives of using the product or service through their deep understanding of the offering as well as the client. In doing so, they can help increase the sales and revenue of the company. A CRO can achieve this by implementing processes and technologies in place to enhance the effect of customer success on income, such as raising customer lifetime value and lowering customer attrition, analyzing and measuring variables related to client success, and putting in place a continuous improvement strategy and coordinating sales with customer success.

Benefits of Hiring a Chief Revenue Officer

Here are five benefits of hiring a Chief Revenue Officer (CRO):

1. Alignment of Cross-functional Departments

CROs work closely with several organizational divisions, including sales, marketing, finance, product development, and customer success. This cooperation encourages a unified and coordinated strategy which leads to improved overall performance, efficient operations, and effective communication.

2. Better Customer Experience

Understanding consumer preferences is one of the more important jobs of a CRO. They can improve customer happiness, retention rates, and enduring loyalty by incorporating consumer insights into revenue initiatives—thus overall bettering the customer experience.

Customers often fall prey to the fragmented structure of the upper hierarchy in most B2B businesses. A CRO oversees customer journeys and helps them out whenever they come across a roadblock.

3. Increased Trust Among Customers

The maintenance of solid relationships with the target accounts is another responsibility of the Chief Revenue Officer (CRO). This can include working directly with the customer success team or conducting the follow-up individually.

CROs are allowed to participate in contract negotiations with valuable clients.

By evaluating the success of the many buyer touchpoints throughout the sales process, the CRO may reverse-engineer a highly optimized sales funnel that anticipates the needs of the ideal customer.

4. Performance Measurement Using Strategic Planning

CROs are essential in creating and carrying out strategic plans to achieve revenue goals. In order to enter new markets, grow existing ones, or launch new goods and services—they analyze market trends, spot growth possibilities, and develop plans.

CROs also determine metrics and key performance indicators (KPIs) to assess the efficiency of their sales efforts and the generation of revenue. To track progress, they pinpoint problem areas and make informed decisions to maximize revenue outcomes, they employ data-driven procedures, and make use of analytics.

5. Revenue Boost

The primary reason a CRO is hired by a business is to ensure greater revenue and strengthen the financial position of the business. To optimize revenue sources and maximize profitability, they are enabled to place a strong emphasis on coordinating sales, marketing, and customer success tactics.

The Chief Revenue Officer is brought on board to close the integration gap because conventional departmental practices frequently stand in the way. They are not restricted to any one department, which allows them to more accurately assess the market, identify new sales channels, and pursue new business opportunities.

What KPIs Should the Chief Revenue Officer Be Responsible For?

So, how can you evaluate whether a chief revenue officer is performing their duties in a way that is boosting your business ROI? Here are five KPIs that can help you assess this:

Revenue: Stating the obvious but analyzing the revenue generated by a CRO’s leadership is the ultimate measure to decide whether it was a good investment for your business.

Retention: Customer retention is another important CRO KPI. While there are many ways to gauge customer retention, the percentage of active customers after a given time frame is a standard indicator. For instance, the percentage of customers who remain active after a year could be used by a business to gauge customer retention. In contrast, if the business uses a subscription model, the rise in subscription renewals could serve as the basis for the KPI. Customer retention can be impacted by a variety of factors, including pricing, the caliber of the product or service, and the degree of customer support provided.

Pipeline: The percentage of the sales pipeline that is made up of current deals is another way to gauge a CRO’s effectiveness. This is a reliable predictor of the sales team’s ability to close enough deals to meet the company’s revenue goals.

Average Deal Size: This CRO KPI can have a major impact on revenue. The average transaction size calculates the average amount of all closed deals for a given business. For sales teams and revenue operations, this number is crucial because it can show if they are typically closing bigger or smaller agreements.

Length of Sales Cycle: The amount of time that passes between making the first contact with a potential customer and closing the deal is known as the length of the sales cycle. While this metric depends on various factors, such as the type of products or services being sold, the intricacy of the transaction, the customer’s purchasing patterns, and the salesperson’s abilities, a CRO is still responsible for reducing the length of the sales cycle by improving the efficiency of their sales staff and streamlining their sales procedures.

Conversion Rates: The conversion or win, rate is yet another important CRO KPI. This shows whether the CRO has made any impactful changes to the sales workflows to increase net revenue or indicates that new tactics or techniques must be implemented.

Hiring a Chief Revenue Officer

Hiring for a role that demands strategic thinking and aims at sustained revenue growth is critical.

Present-day marketing is divided into 3 stages: Planning → Execution → Analysis

Through these stages, a CRO is accountable for:

- Identifying opportunities that can convert into sales, and ultimately add to revenue.

- Allocating budget, and resources relevant for teams as per the revenue goals.

- Operationalizing sales and marketing, to maximize foreseeable returns.

- Tracking touchpoints of the buyer journey to understand customer behavior from the first engagement to the deal closure.

- Analyzing collected data to evaluate performance from the standpoint of revenue, identifying gaps and building future strategy based on the measurable wins.

Hiring a CRO with a great understanding of inbound marketing and prominent experience across different channels is a must for any business that wants to create value for customers. A chief revenue officer is a problem-solver and leader by nature. She is the one who self-starts and encourages others to work toward the big goal. While you go out to hire one, you cannot compromise on certain personal attributes like:

- Integrity & Maturity

- Outstanding Communication

- Analytical thinking

- Leadership abilities

- Business judgment & finance

- Understanding of multiple teams/functions

What are the Top 5 Traits You Should Look for in Your Chief Revenue Officer?

Here are the top five traits of an exceptional CRO:

Inspired and Enterprising

A successful CRO must be bold and assertive while remaining stable and reliable. They must concentrate on telling stories rather than just reaching the numbers. A forward-thinking CRO is well aware of the company’s potential for expansion, and can effortlessly combine business judgment with his financial expertise.

Data-driven

CROs control product structure, price, and the buyer’s journey. They must be data-obsessed if they want to make wise decisions. To find the answers to critical concerns like how to make it simpler for customers to purchase when selling subscriptions and how to target the right customers on the right channel at the right time for upsells and cross-sells, researchers examine customer behavior. They frequently use CRM software to unify all teams’ data around a single customer view.

Agile and Adaptive to Change

For a job that mostly requires consistency, an adept CRO needs to be prepared for big shifts as well. Listed below are some challenges that CROs have faced in the recent past and may be feeling the repercussions of, even now.

An increase in business complexity: More than ever, customers want shopping to feel simple. They also desire the option to purchase using different revenue models, such as subscriptions, and the ability to switch between channels (for instance, starting with a self-service channel and finishing with a sales representative). Chief revenue officers must adapt to all of this change while continuing to provide amazing, connected, and personalized experiences.

The great resignation of 2020-2021: In 2022, 55% of Americans were expected to change employment, according to the August 2021 Bankrate Jobseeker Survey. More than ever, chief revenue officers had to put forth more effort to retain their top employees.

The advent of the hybrid workforce: CROs are frantically searching for fresh approaches to synchronize teams, whether they are based remotely or in the office. To engage this hybrid workforce, they have to upskill and learn new digital tools, such as Slack-first sales and remote coaching tools powered by AI.

“Builder” Mindset

Elison Elworthy, EVP of Revenue Operations, at HubSpot, says technical skills are not the most important skills of a successful RevOps professional. According to her — “At its core, ReOps is about taking disparate teams and tools and bringing them together to build an operating system that’s greater than the sum of its parts. By adopting this mindset…operations professionals can transform the way their business runs, even if they don’t know their Python from their PHP.”

CROs, therefore, need seasoned executives who develop both people and culture in addition to income. They devote a lot of time to coaching their teams, and they get their inspiration from creating a work environment that inspires employees to give their all.

Resilient Under Crisis

Compared to their C-level peers, CROs are clearly “on the hook” and have the most board accountability. A prosperous CRO can, however, carry this weight and succeed. They can handle the pressure and take advantage of the benefits, which include not-too-shabby remuneration in stock and equity, the satisfaction of outperforming the competition, and the opportunity to build a fantastic team and business.

Finally, you should know why you are hiring a CRO- yes revenue is the major aspect but the job of CRO is more process-driven as his/her presence can be felt at every stage of revenue generation. A chief revenue office is basically the one who identifies wastage beforehand and turns it into an opportunity to be more productive and enables proper utilization of resources- be it tools, people, or budget. So, the role demands of wearing multiple hats- someone who is capable of that is the best hire for the chief revenue officer’s role.

Sales and marketing people have the same goal, i.e., selling. It used to be different some time ago but now marketers talk about sales- and the sales team facilitates a better understanding of customers. But to align both, you require an expert who has a deep understanding of all sales and marketing channels. It’s the CRO who is ultimately responsible for giving a unified view to teams working in different departments.

The role of a CRO has become more relevant going into 2021 when companies are emerging from the forced situations that led to cost-cutting and changed work environments. COVID-19 has changed the B2B reality as companies have reformulated their sales model and embraced the digital transformation to reach and serve customers. 70% of B2B frontrunners say that they are ready to spend more than $500,000 on fully self-serve and remote sales models (Mckinsey).

Most of the B2B companies have shifted their focus from traditional to digital, owing to the predictability and scalability of a digitally automated sales process. Considering the growth in digital adoption, we may see more of such businesses leaning on digitized models to expand revenue channels. As digital adoption grows more, the predictable sales model also comes into the picture automatically. The role of a CRO is imperative to this new revenue generation system.

Sell more, understand your customers’ journey for free!

Sales and Marketing teams spend millions of dollars to bring visitors to your website. But do you track your customer’s journey? Do you know who buys and why?

Around 8% of your website traffic will sign up on your lead forms. What happens to the other 92% of your traffic? Can you identify your visiting accounts? Can you engage and retarget your qualified visitors even if they are not identified?