Lead Scoring vs Signal-Based Selling: What’s Better for Modern B2B Sales?

We are living in the era of buzzword-driven marketing. The fancier the term and the more AI it has, the better it’s going to be… Or, is it?

Lead scoring is no new concept. It is a simple rule-based system that takes into account a prospect’s business details and interactions with your website, emails, etc., to determine which leads are “qualified” and more likely to convert. The strategy has worked reliably for years, but buyers have now pulled ahead.

With today’s buyer journey increasingly shifting into the “dark funnel,” sales reps are under growing pressure to identify opportunities before it’s too late. This has led to a desire to collect a customer’s digital footprint as much as possible from all around the web and make sense of it.

Businesses now want to use as much data and AI-enabled tech as possible to identify potential customers who are in the market looking for a solution. They want to do this by capturing “signals” from the market through data and tech provided by third-party vendors.

However, as the floodgates open to a seemingly endless stream of signals (website behavior, social media interactions, content consumption, job changes, etc.), the question arises: does all this data really give us the clarity we need, or is it just adding to the noise?

Image Source: Infuse.com

While traditional lead scoring was simple and clear in nature, signal-based selling, with its flashy algorithms and behavioural cues, seems more mysterious. But is it truly more effective? Let’s find out.

What is Lead Scoring?

Lead scoring is a rule-based system that primarily relies on first-party data. This data is collected directly from your own website, marketing channels, or CRM systems (called first-party data). The method ranks prospects against a scale in numerical values and uses rules to positively or negatively score leads based on characteristics and actions.

The main advantages of rule-based lead scoring are its reliability, simplicity, and clarity. Because the data used for scoring comes directly from your own interactions with the prospect, it’s easy to understand and track. On top of that, the data is also generally compliant with data regulations as it’s collected with the prospect’s consent.

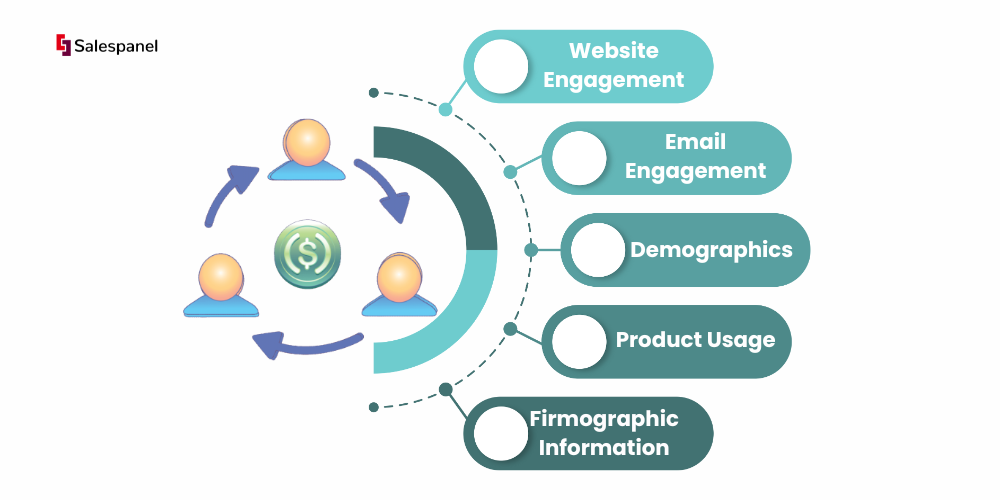

Here’s a list of some of the most commonly used data points for lead scoring:

Website Engagement: Activity on your own website.

Email Engagement: Activity on your email and newsletter campaigns.

Demographics: Location, job role, company, etc.

Product Usage: Engagement with the product.

Firmographic Information: Company size, industry, employee count, etc.

You can read our complete guide on B2B lead scoring here.

What is Signal-Based Selling?

Signal-based selling is a modern sales approach that involves tracking a variety of signals to guide sales enablement and qualification. This approach combines both first-party (information collected directly from your interactions) and third-party (information gathered from external sources and vendors) data points to determine the intent of the buyer.

While “signals” might sound like a fancy word, it’s a technical umbrella term for any observable behavior that might indicate buyer intent. Apart from your own data sources, many of these signals are also captured from second-party sources (like partner websites) and third-party sources such as intent data providers, review platforms, etc.

Here’s a list of some of the most commonly used signals:

First Party:

Website Engagement: Activity on your own website.

Email Engagement: Activity on your email and newsletter campaigns.

Demographics: Location, job role, company, etc.

Product Usage: Engagement with the product.

First-party Social Activity: Engagement with your brand on social media.

Third-Party Data:

Firmographic Information: Company size, industry, employee count, etc.

Technographic Information: Tech profiling of the prospect’s website.

Social Activity: Engagement on platforms like LinkedIn.

Intent on Review Platforms: Track when accounts research your category or competitors on platforms like G2.

Browsing Behavior: Identifying accounts that are researching your category or industry on the web.

Job Changes: Identifies when potential accounts have new people in leadership positions.

Aside from buying signals, there is another secret sauce to a good signal-based selling model — AI.

AI helps these models process large datasets to not only identify prospects who are more likely to purchase but also provide actionable insights to convert them. Plus, these models can learn to improve themselves over time.

AI in signal-based selling helps in:

- Processing large chunks of signals in real-time.

- Deriving actionable insights from them.

- Predict outcomes and identify prospects that should be prioritised

- Learn from past data to improve future outcomes

With tons of data to work with, AI is what makes a signal-based selling strategy work. And, this will only improve over time!

Image Source: Forecom-solutions.com

Signal-based Selling vs Lead Scoring: How are they different?

The main advantages of lead scoring are its reliability and clarity. Because the data used for scoring comes directly from your own interactions with the prospect, it’s easy to understand and track. To add a cherry on top, the collection of this data is also generally compliant with various regulations, as it’s collected with the prospect’s consent.

So, the question is — If lead scoring is reliable and accurate, why is there a need for a more complex AI-driven system that uses a lot of third-party data beyond your control?

Lead scoring works, but the truth is…

Strategies to qualify buyers are continuously evolving because the days of a hard sales call being the clincher for a B2B deal are over. Today’s buyers are ahead of sellers, conducting extensive research and narrowing down choices before they ever speak to a sales rep. 80% of B2B buyers initiate first contact only after completing 70% of their purchasing journey. By the time a lead enters your funnel, they already have a preferred vendor in mind.

This shift has led businesses to re-evaluate the effectiveness of a first-party data-focused scoring model. Teams have started to believe that by the time a lead drops into their funnel, it is already too late.

Leadership teams are now yearning for third-party intent signals and AI-powered systems to give them a competitive edge. With prospects actively researching your category and considering competitors, understanding real-time intent signals feels crucial.

Signal-based selling addresses this problem as it expands beyond first-party data to include real-time behavioral signals from both internal and external sources. The strategy helps you to swoop in right when potential buyers are evaluating solutions and your competitors. This could include things like a prospect researching your category on G2, engaging with a competitor on LinkedIn, or even signing up for a competitor’s product demo (tracked through technographic data).

And then, there’s the AI angle. While lead scoring uses simple, human-defined rules and mathematics to rank prospects, signal-based selling heavily relies on AI to make decisions. The models can learn from complex datasets, process large amounts of data faster, and improve themselves without human intervention.

Here’s a detailed breakdown:

| Feature | Signal-Based Selling | Lead Scoring |

| Methodology | Event-triggered signals with predictive assistance | Simple rules-based system |

| Data Source | First-party and third-party data (e.g., intent data, key company events, etc.) | Primarily first-party data (e.g., website interactions, form submissions) |

| Responsiveness | Reacts to real-time buyer behaviors and signals | Some systems use static data while others also take real-time inputs |

| Signals Tracked | Product usage, website interactions, social media, job changes, intent data from platforms like G2, LinkedIn | Product usage, website interactions, email engagement, demographic data, form submissions |

| Scope of Insights | Broad: captures both internal and external signals, offering a more holistic view of buyer intent | Narrower: relies mostly on internal behaviors and predefined criteria |

| Complexity | High: integrates both first-party and third-party data and requires real-time analysis | Low: simple point system based on predefined rules and behaviors |

| Actionable Insights | Provides real-time, actionable insights into buying intent | Limited actionable insights; provides a ranking of leads based on predefined characteristics |

| Compliance | May require careful handling of third-party data (depending on regulations) | High: primarily uses data collected with consent from your own ecosystem |

| Adaptability | Adaptive to new buyer behavior and market trends | Less adaptable to changes in buyer behavior or external factors |

| Engagement Opportunities | Can identify leads earlier in the buying process, even before they engage with your brand | Generally identifies leads who have already engaged with your brand |

| Example of Signals | Research on G2, competitor interaction on LinkedIn, job changes | Visiting a pricing page, downloading a case study, email opens |

| Operational Needs | Requires the integration of multi-source data and intensive training for teams | Requires defining & maintaining rules |

Is Signal-Based Scoring Better Equipped For The Changing Buyer Journey?

It is clear that the buyer journey is changing, with buyers now being in full control. As AI-assisted buying evolves, you will notice that more buyers are engaging with the likes of ChatGPT and Perplexity and collecting information from sources like G2 and Reddit, even before they open any conversations with you. Waiting for them to download your ebook or whitepaper might mean that you are already late!

Traditional lead scoring is great, but it is fundamentally ill-equipped to detect intent manifesting solely in these hidden channels. Businesses now feel that signal-based selling presents an intriguing proposition, one that can help insert themselves into the decision-making process earlier than competitors.

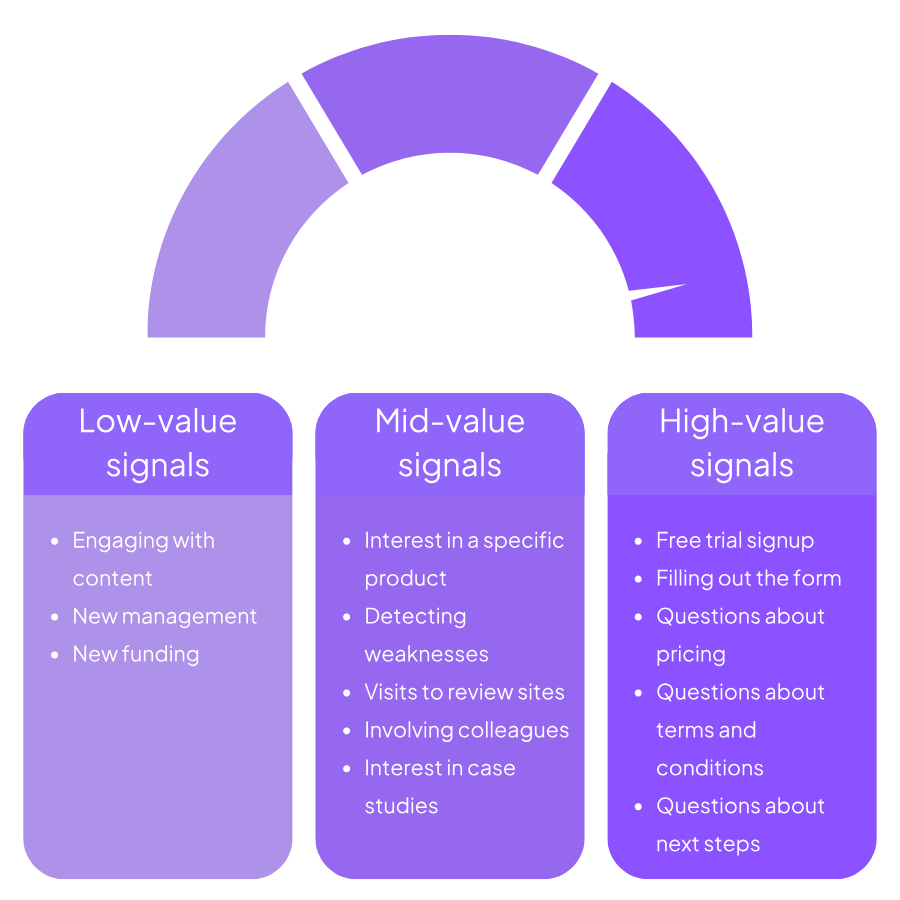

Signals like a job change here or a topic research there give sales teams the ability to engage with buyers before competitors reach out to them, or worse, before they’re already deep into solution evaluation and have already made up their minds.

The pitch is clear: identify intent earlier than ever before and act on it with proactive, context-rich outreach. But does that mean a signal-based selling model is a no-brainer over lead scoring in all situations? Well, not really!

The reliance on third-party intent signals is a much-needed response to a market that no longer behaves in neat, trackable patterns, especially for B2B. However, relying on these signals will also mean that:

- You have too much information to work with.

- You are not sure about the accuracy of the information.

- You are now relying on vendors for data compliance.

Lead scoring being simple isn’t a bug; it’s a feature. It works well for smaller brands that would rather have a simple but effective model (relying on limited data) instead of working with AI engines that nobody in the team trusts or understands. Signal-based selling is here to address the dark funnel and help you stay ahead of the curve. However, whether it can be implemented predictably and reliably while adhering to data regulations remains to be seen.

Signal Fatigue, Questionable Accuracy, and a Lack of Insights That Actually Matter

Signal-based selling feels all sunshine and roses. What can be better than learning about potential customers even before they engage with you? And, what can be better than using AI magic to predict buyer motivations, uncover the dark funnel, and send personalised outreach when an account shows strong intent?

On the surface, this feels like the perfect solution for today and the future to come, but more doesn’t always mean better. A data-heavy workflow can be great, but it will only work when the data is accurate and relevant to your business.

Here are a few problems you can face if you ditch a good old lead scoring system and opt for AI and signals-based models:

1. AI can turn good data into actionable insights, but it can also amplify bad inputs

In an ideal world, where your third-party data is absolutely spot on, AI can piece together and amplify chunks of data into highly actionable insights, helping you close deals faster. However, if the input data turns out to be flawed or misleading, your fancy AI system can destroy your pipeline and cause a loss in revenue. Your sales team ends up chasing false positives, prioritising the wrong prospects, and wasting time.

Flawed data can accelerate you towards the wrong results (bad leads, high churn risk customers, etc.), and caution must be advised if you plan to create such a pipeline.

2. Too many signals can confuse marketing teams and cause signal fatigue

Sometimes, less is more. Having too many signals can cause confusion and frustration among marketing teams, which can cause them to run the wrong campaigns. For example, if your marketing team finds out through a traditional funnel that a certain eBook generates the most leads that turn into MQLs, they will promote that eBook or create similar ones in the future. The information in this case is limited but highly actionable.

On the other hand, if your marketing team had access to tons of data and different signals, it could confuse decision-making and induce biases through unimportant signals. If these signals do not always produce desirable or predictable results for marketing teams, they can grow desensitised to these signals.

3. Analysis paralysis can happen to both humans and AI agents

With too many signals, both human and AI agents can quickly fall into analysis paralysis. If your team and AI setups are bombarded with hundreds of signals, how will they know which ones are actually important?

Sales teams waste precious time sorting through signals that, in the end, don’t provide meaningful insight into whether a prospect is truly ready to make a purchase. Your AI model might also incorrectly interpret unimportant signals or overanalyse signals and derive flawed conclusions. This can very easily become counterproductive, making it harder for everyone to understand what truly matters.

4. Sales reps can drown in signals and lose trust in the system

Sales reps have always hated marketing teams because they believe the leads they get aren’t either good enough or qualified enough. And, this has happened when marketers have given sales teams leads that are sourced, qualified, and warmed up through reliable in-house systems. Imagine what will happen when sales teams have to work with leads, many of which end up being duds because of misinterpreted signals?

A good system will do wonders for your team, but a flawed system with many misses and too much information can frustrate your sales reps and have them lose trust in the system. If signals and constant alerts bother them, they can end up becoming desensitised to the very signals they’re supposed to prioritise.

5. A lot of intent data in the market is snake oil!

The intent data that we have access to comes from third-party vendors. Many of these vendors are secretive about their methodologies and what they might consider intent. Just because one person from a 500-employee business researched your category or checked out a competing product does not mean the business is seriously in the market for a new product. Plus, only about 5% of B2B buyers a

Vendors often position intent data as a crystal ball into the buyer’s mind in their sales pitches. In real life, however, the practical application frequently looks more like a distorted mirror. The data is often aggregate and probabilistic, telling you that a company is researching a topic, not which specific contact has genuine, immediate intent. If your signal-based system heavily relies on third-party intent data and the intent data is dubious, your system will fail!

6. Sales reps can end up over-prioritising the wrong accounts while disregarding insights that matter

Traditional lead scoring systems give you a breakdown of how the scoring has happened. A sales rep working on an account can clearly understand why the system considers a lead qualified and if they should be pursued. A signal-based system, on the flip side, is largely a black box.

If they have to work with signal-based scoring, they have to put faith in the system. If the system is flawed, sales reps can end up over-prioritising unqualified accounts because the system has concluded the account to be important. During this process, sales reps chase low-quality opportunities, while genuine prospects slip through unnoticed. Without clear guidance, teams risk misallocating resources, ultimately hurting their bottom line.

7. Regulatory challenges and privacy concerns

Regulatory bodies are trying to crack down on the data you track about your customers. Due to its nature, signal-based selling needs you to track way more data than you would have with traditional lead scoring setups. And because some of these datapoints come from third parties, this makes compliance a bigger challenge.

The more signals you track, especially from third-party sources, the more you’ll run into regulatory hurdles like GDPR or CCPA. Capturing intent data from external channels can raise questions about privacy and consent, creating compliance headaches and potential legal risks. On top of that, any future regulatory changes might void your model or cause trouble for you. Do keep them in mind when you want to implement signal-based selling.

8. Signal-based data+tech setups cost 2-3X more

A signal-based selling model needs you to pay for both tech and data from multiple vendors. While your costs would be highly dependent on what you use and how you set your model up, it should at least be 2- 3X more than what you would have to pay for a lead scoring model.

With Salespanel, you can set up a lead scoring model for around $250/month (including the cost of data+tech). For a signal-based model, you would need to pay multiple vendors, and the cost can come to anywhere between $1000 and $ 5000/month. Therefore, paying the extra premium for this fancy setup would only make sense if the ROI is clearly attributable.

9. Requires intensive training and interpretation

Signal-based models are complex and need your team to be aware of the unknown unknowns and how they judge signals. If training and interpretation are not done correctly, they can easily get overwhelmed by the signals, prioritise the wrong signals, or just get desensitised to any signal notifications.

To get this setup right, both marketing and sales teams need intensive training to interpret signals correctly and make the right calls. Without proper training, sales reps could misread signals, make incorrect assumptions, and mishandle outreach.

10. Might not work for smaller businesses or niches with limited data

Signal-based selling thrives on volume and data. Think Amazon! They have so much data, every important signal can be segregated and made sense of. If you are a small business with limited data, signal-based selling might not be the right choice for you.

Small signals, which are anomalies or do not mean anything, can be incorrectly considered to be important. Use this strategy only if you operate in volume.

Signal-based selling is an exciting prospect for identifying buying intent and discovering new buyers, but it’s not without its flaws and risks. Choose this model only if it is the right fit for your business.

Moving Forward: What Sales Teams Truly Need!

As we look ahead to an uncertain future, it’s hard to predict what lies ahead of us. Will we have a new entrant in the market that provides extremely reliable data and actionable signal data? Will AI develop the capability to effectively distinguish between important and unimportant signals, ensuring better decision-making? Will the ROI from signal-based selling consistently outpace traditional lead scoring systems? Are future regulations going to target the use of third-party data?

We do not really know!

As of today, it is clear that neither lead scoring nor signal-based scoring is a one-size-fits-all solution. Signal-based selling offers deeper insights and can give you an edge over competitors by identifying intent earlier. On the f lip side, traditional lead scoring remains reliable, straightforward, and with fewer regulatory concerns.

If you are a small business with limited volume but clear data. For example, if you are able to determine intent from very specific actions and can qualify leads based on very specific information, lead scoring should still be the right fit for you. Salespanel should serve your purposes as it can aggregate first-party data about your prospects and help you create the right lead scoring model for your business.

That said, if you have a high volume of traffic and simple mechanics are not enough for you to correctly determine intent or grow further, signal-based selling is a good option. You can also try out both models to figure out what works for you.

We may not have all the answers about the future of sales, but one thing remains true: human judgment and human-driven sales processes still rule. An AI model can predict patterns, but it also hallucinates. The system might not even be able to beat the gut feel of your best sales reps. Sales evolve as tech evolves, and balancing both human and machine elements should serve as the perfect recipe.

Sell more, understand your customers’ journey for free!

Sales and Marketing teams spend millions of dollars to bring visitors to your website. But do you track your customer’s journey? Do you know who buys and why?

Around 8% of your website traffic will sign up on your lead forms. What happens to the other 92% of your traffic? Can you identify your visiting accounts? Can you engage and retarget your qualified visitors even if they are not identified?